Exhibit c(iii)

– Highly Confidential; For Discussion Purposes Only – January 21, 2024 Discussion Materials for the Special Committee Project Hydro

– Highly Confidential; For Discussion Purposes Only – Disclaimer This presentation has been prepared by Centerview

Partners LLC (“Centerview”) for use solely by the Special Committee of the Board of Directors of HireRight Holdings

Corporation (“Hydro”, the “Company” or the “Special Committee”) in connection with its evaluation

of proposed strategic alternatives for Hydro and for no other purpose. The information contained herein is based upon information

supplied by or on behalf of Hydro and publicly available information, and portions of the information contained herein may be

based upon statements, estimates and forecasts provided by Hydro. Centerview has relied upon the accuracy and completeness of

the foregoing information, and has not assumed any responsibility for any independent verification of such information or for

any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Hydro or any other entity,

or concerning the solvency or fair value of Hydro or any other entity. Any financial analysis in this presentation is complex

and is not necessarily susceptible to a partial analysis or summary description. In performing any financial analysis, Centerview

has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular

portion of the analysis considered. Furthermore, selecting any portion of Centerview’s analysis, without considering the

analysis as a whole, would create an incomplete view of the process underlying its financial analysis. Centerview may have deemed

various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion

of the analysis described above should not be taken to be Centerview’s view of the actual value of Hydro. These materials

and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be

disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any

other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of

the Board of Directors of Hydro (in its capacity as such) in its consideration of strategic alternatives, and are not for the

benefit of, and do not convey any rights or remedies for any holder of securities of Hydro or any other person. Centerview will

not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials

are not intended to provide the sole basis for evaluating strategic alternatives, and this presentation does not represent a fairness

opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction

with the oral presentation provided by Centerview.

– Highly Confidential;

For Discussion Purposes Only – Executive Summary ▪ Centerview is progressing the workplan discussed with the Special

Committee ▪ In the filing dated December 8, 2023, the Sponsors indicated they are “interested only in pursuing the

Proposed Transaction(1) and do not intend to sell [their] respective stakes in the Company to any third party” ▪ As

context for the Special Committee, today’s materials reflect potential third party alternatives and considerations for Hydro,

notwithstanding the Sponsors’ stated intent Source: Company filings. (1) As defined in the December 8, 2023 proposal.

– Highly Confidential;

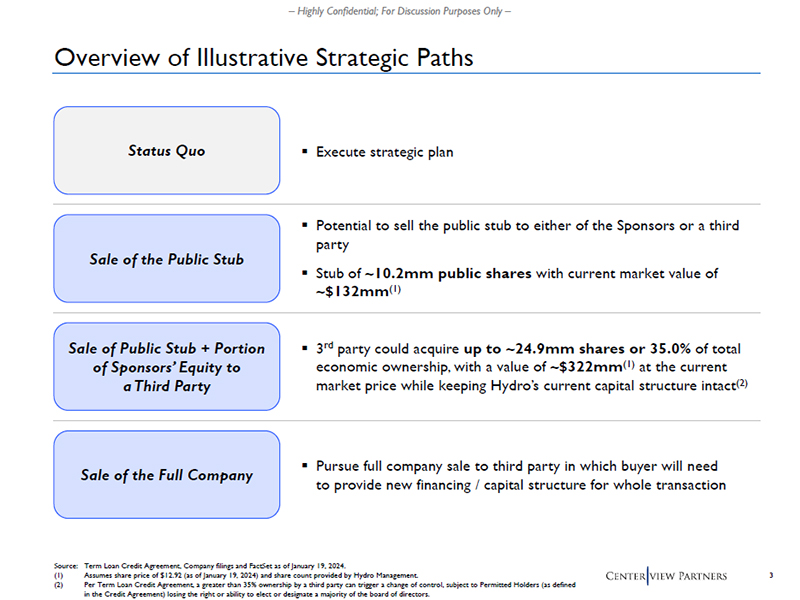

For Discussion Purposes Only – Overview of Illustrative Strategic Paths Status Quo Sale of the Public Stub Sale of Public

Stub + Portion of Sponsors’ Equity to a Third Party ▪ Execute strategic plan ▪ Potential to sell the public

stub to either of the Sponsors or a third party ▪ Stub of ~10.2mm public shares with current market value of ~$132mm(1)

Source: Term Loan Credit Agreement, Company filings and FactSet as of January 19, 2024. (1) Assumes share price of $12.92 (as

of January 19, 2024) and share count provided by Hydro Management. (2) Per Term Loan Credit Agreement, a greater than 35% ownership

by a third party can trigger a change of control, subject to Permitted Holders (as defined in the Credit Agreement) losing the

right or ability to elect or designate a majority of the board of directors. ▪ 3rd party could acquire up to ~24.9mm shares

or 35.0% of total economic ownership, with a value of ~$322mm(1) at the current market price while keeping Hydro’s current

capital structure intact(2) Sale of the Full Company ▪ Pursue full company sale to third party in which buyer will need

to provide new financing / capital structure for whole transaction

– Highly Confidential;

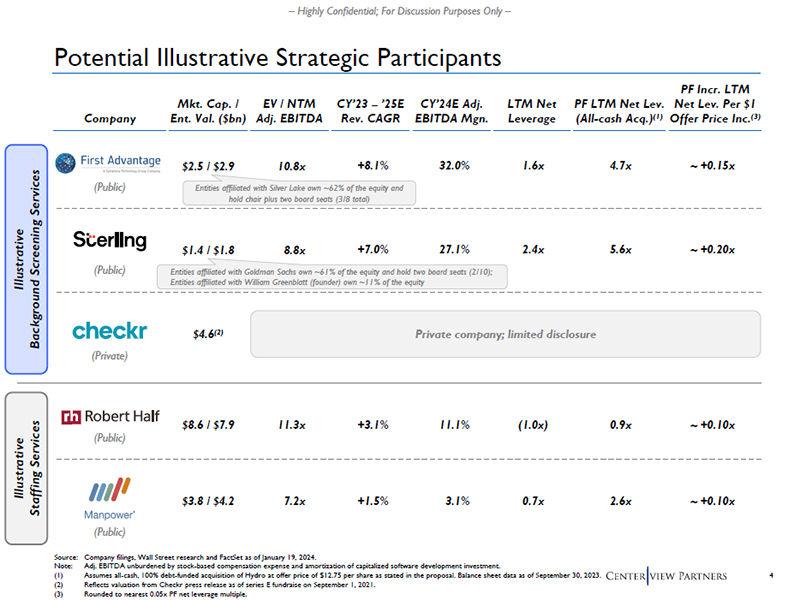

For Discussion Purposes Only – Potential Illustrative Strategic Participants Source: Company filings, Wall Street research

and FactSet as of January 19, 2024. Note: Adj. EBITDA unburdened by stock-based compensation expense and amortization of capitalized

software development investment. (1) Assumes all-cash, 100% debt-funded acquisition of Hydro at offer price of $12.75 per share

as stated in the proposal. Balance sheet data as of September 30, 2023. (2) Reflects valuation from Checkr press release as of

series E fundraise on September 1, 2021. (3) Rounded to nearest 0.05x PF net leverage multiple. Company Illustrative Background

Screening Services Illustrative Staffing Services Mkt. Cap. / Ent. Val. ($bn) $2.5 / $2.9 $1.4 / $1.8 $4.6(2) $8.6 / $7.9 $3.8

/ $4.2 EV / NTM Adj. EBITDA 10.8x 8.8x 11.3x 7.2x LTM Net Leverage 1.6x 2.4x (1.0x) 0.7x CY’23 – ’25E Rev. CAGR

+8.1% +7.0% +3.1% +1.5% CY’24E Adj. EBITDA Mgn. 32.0% 27.1% 11.1% 3.1% Private company; limited disclosure PF LTM Net Lev.

(All-cash Acq.)(1) 4.7x 5.6x 0.9x 2.6x (Public) (Public) (Private) (Public) (Public) Entities affiliated with Silver Lake own

~62% of the equity and hold chair plus two board seats (3/8 total) PF Incr. LTM Net Lev. Per $1 Offer Price Inc.(3) ~ +0.15x ~

+0.20x ~ +0.10x ~ +0.10x Entities affiliated with Goldman Sachs own ~61% of the equity and hold two board seats (2/10); Entities

affiliated with William Greenblatt (founder) own ~11% of the equity

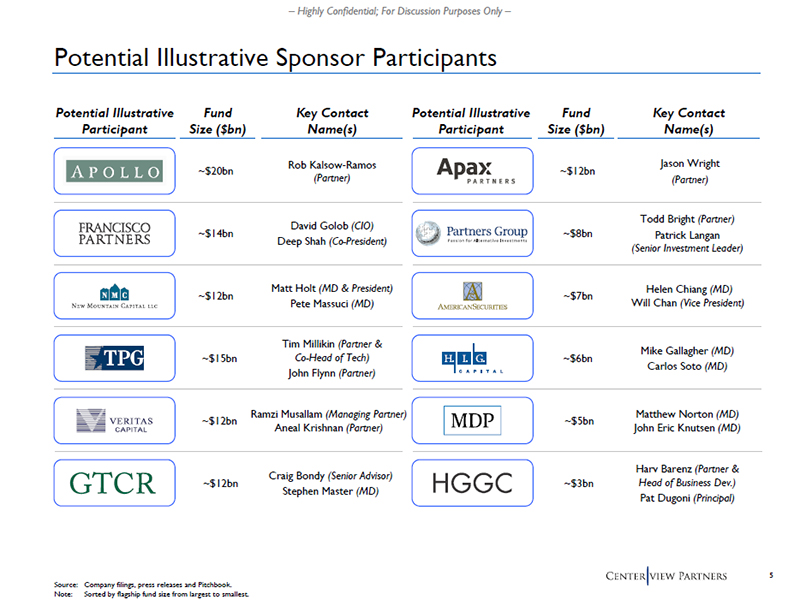

– Highly Confidential; For Discussion Purposes Only – Potential Illustrative Sponsor Participants Potential Illustrative Participant Fund Size ($bn) Key Contact Name(s) Source: Company filings, press releases and Pitchbook. Note: Sorted by flagship fund size from largest to smallest. Potential Illustrative Participant Fund Size ($bn) Key Contact Name(s) Craig Bondy (Senior Advisor) Stephen Master (MD) ~$12bn ~$8bn Todd Bright (Partner) Patrick Langan (Senior Investment Leader) Helen Chiang (MD) Will Chan (Vice President) ~$7bn ~$5bn Matthew Norton (MD) John Eric Knutsen (MD) ~$3bn Harv Barenz (Partner & Head of Business Dev.) Pat Dugoni (Principal) ~$14bn David Golob (CIO) Deep Shah (Co-President) Matt Holt (MD & President) Pete Massuci (MD) ~$12bn ~$20bn Rob Kalsow-Ramos (Partner) ~$6bn Mike Gallagher (MD) Carlos Soto (MD) ~$15bn Tim Millikin (Partner & Co-Head of Tech) John Flynn (Partner) Jason Wright (Partner) ~$12bn Ramzi Musallam (Managing Partner) ~$12bn Aneal Krishnan (Partner)